All Categories

Featured

Table of Contents

[/image][=video]

[/video]

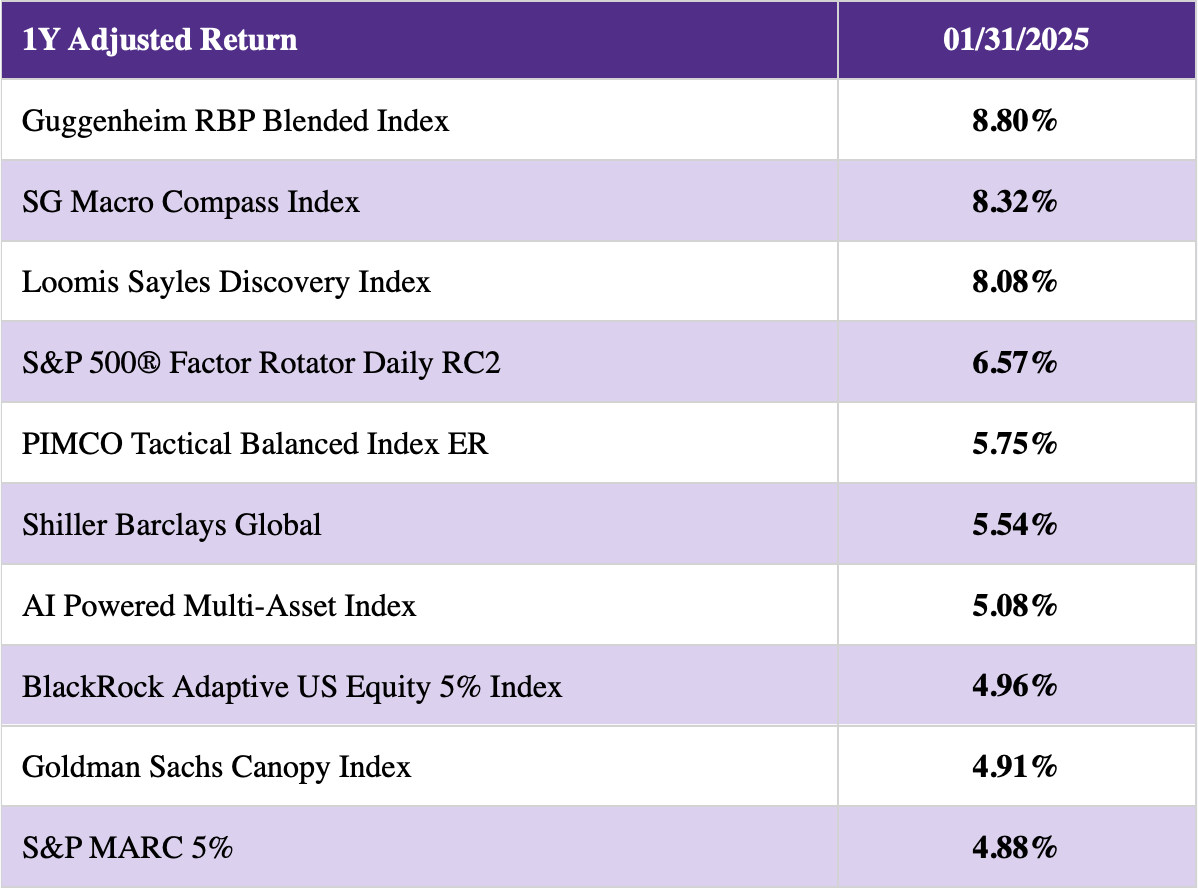

Yet the landscape is shifting. As rate of interest decrease, fixed annuities might lose some charm, while items such as fixed-index annuities and RILAs gain traction. If you remain in the marketplace for an annuity in 2025, store carefully, compare alternatives from the most effective annuity companies and prioritize simpleness and transparency to locate the ideal suitable for you.

When picking an annuity, monetary strength ratings matter, yet they do not inform the whole tale. Right here's how contrast based on their rankings: A.M. Finest: A+ Fitch: A+ Criterion & Poor's: A+ Comdex: A.M. Ideal: A+ Fitch: A+ Moody's: A1 Requirement & Poor's: A+ Comdex: A.M. Best: A+ Moody's: A1 Standard & Poor's: A+ Comdex: A greater economic score or it just reflects an insurance firm's financial strength.

A lower-rated insurance firm may provide a, resulting in substantially more revenue over retirement. If you concentrate just on ratings, you could The very best annuity isn't just concerning firm ratingsit's about. That's why comparing actual annuity is more crucial than simply checking out financial strength scores. There's a great deal of sound available when it concerns monetary advice about annuities.

That's why it's essential to get guidance from a person with experience in the industry. is an staffed by independent qualified monetary professionals. We have years of experience aiding people discover the right items for their needs. And since we're not associated with any company, we can give you unbiased advice about which annuities or insurance coverage are appropriate for you.

We'll aid you sort via all the alternatives and make the very best decision for your situation. When selecting the finest annuity business to suggest to our clients, we use an extensive method that, after that from there that consists of the following standards:: AM Ideal is a customized independent rating company that examines insurance policy business.

And bear in mind,. When it comes to dealt with annuities, there are lots of alternatives around. And with many selections, understanding which is ideal for you can be difficult. But there are some things to try to find that can aid you limit the field. Go with a highly-rated business with a strong credibility.

Annuity Practice Problems

And ultimately, pick an annuity that is very easy to understand and has no gimmicks. By following these standards, you can be sure you're getting the most effective possible offer on a repaired annuity.: Oceanview Annuity due to the fact that they tend to have greater rates of interest with standard liquidity. ("A" rated annuity firm): Clear Spring Annuity due to the fact that they are simple, solid annuity rates and conventional liquidity.

Some SPIAs supply emergency liquidity includes that we like.

There are a few crucial aspects when looking for the best annuity. Contrast passion prices. A higher passion rate will certainly use more development capacity for your financial investment.

This can promptly enhance your investment, however it is necessary to understand the terms affixed to the bonus offer before investing. Ultimately, think of whether you desire a lifetime earnings stream. This kind of annuity can provide peace of mind in retired life, but it is important to guarantee that the income stream will be appropriate to cover your demands.

These annuities pay a set monthly quantity for as lengthy as you live. And also if the annuity lacks money, the regular monthly settlements will certainly continue coming from the insurance provider. That indicates you can relax easy understanding you'll constantly have a steady earnings stream, despite for how long you live.

Tax On Annuity Beneficiary

While there are a number of various kinds of annuities, the ideal annuity for long-lasting treatment prices is one that will certainly pay for a lot of, otherwise all, of the costs. There are a few things to think about when picking an annuity, such as the size of the contract and the payment choices.

When choosing a set index annuity, contrast the offered items to locate one that best suits your needs. Take pleasure in a life time income you and your spouse can not outlast, supplying economic protection throughout retirement.

Chase Insurance Life And Annuity

Furthermore, they enable as much as 10% of your account value to be withdrawn without a fine on a lot of their item offerings, which is more than what most various other insurance provider permit. An additional factor in our referral is that they will enable elders up to and consisting of age 85, which is additionally higher than what a few other business allow.

The best annuity for retired life will certainly depend on your individual needs and objectives. An appropriate annuity will certainly provide a steady stream of earnings that you can depend on in retirement.

Symetra Custom 7 Annuity

They are and constantly supply some of the highest payouts on their retirement earnings annuities. While prices rise and fall throughout the year, Integrity and Warranty are normally near the top and maintain their retirement revenues competitive with the various other retirement earnings annuities in the market.

These scores offer customers a concept of an insurance firm's economic stability and just how most likely it is to pay out on insurance claims. It's essential to keep in mind that these scores do not necessarily show the high quality of the products supplied by an insurance policy firm. An "A+"-rated insurance policy firm can use products with little to no development potential or a reduced income for life.

Your retirement savings are likely to be one of the most vital investments you will ever make. If the insurance business can not obtain an A- or much better rating, you ought to not "wager" on its capability long-term. Do you desire to bet money on them?

Latest Posts

Best Fixed Annuity Rates In Virginia - Mar 2025

Variable Annuity Companies

Clear Spring Annuity